puerto rico tax incentives code

On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. Internal Revenue Code generously exempts Puerto Rico-sourced income from federal income tax and under Chapter 2 of Act 60 Puerto Rico residents pay minimal or possibly no taxes on interest dividends and certain capital gains.

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Exempt business in Culebra and Vieques and new small and medium sized businesses have access to higher tax incentives see below.

. It offers the following main tax benefits. As of 2020 Puerto Rico actually consolidated all of these tax acts into one Act 60 of the Incentives Code. Taxes levied on their employment investment and corporate income.

With an ever-growing array of services and emerging industries part of your success will be directly attributable to the incentives available. In order to bolster a diversified economy the local government has. This new section allows for telemedicine and other export services.

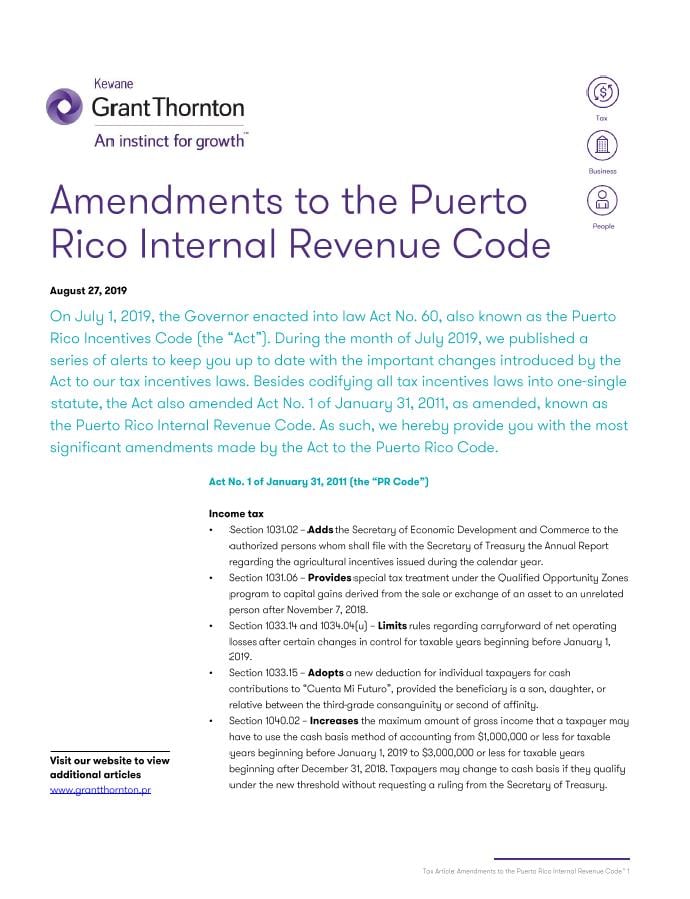

Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the application and awarding of the benefits granted under this law. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed.

In order to promote the incentives and a favorable regulatory environment to establish Qualified Opportunity Zones in Puerto Rico. Puerto Rico Incentives Code Act 602019 Signed into Law. As of July 11 2017 Puerto Ricos tax incentive Act 14 can be combined with Act 20.

Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation. As provided by Puerto Rico Incentives Code 60.

Under this program investors and their spouses and unmarried children under 21 are eligible to apply for a Green Card permanent residence if they. Comunidades Especiales de Puerto Rico. Plan to create or preserve 10 permanent f.

The new law does NOT eliminate the existing incentives. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Incentives Code. While the federal tax code helped create the conditions for Puerto Ricos fiscal crisis after Congress repealed the Section 936 tax incentives for subsidiaries of US.

Many high-net worth Taxpayers are understandably upset about the massive US. The purpose of the bill was to consolidate all tax and monetary benefits conferred through separate statutes into a single code and eliminate tax incentives that were. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

More importantly the requirements for each program have been adjusted. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. 21 of 14 May 2019 also known as the Development of Opportunity Zones of Economic Development Act of.

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years. Puerto Ricos statutory corporate income-tax rate is 20 percent and its top marginal income tax for corporations. Puerto Rico Agricultural Tax Incentives Act.

Companies on the island a trimming of incentives is needed. Few places on earth offer a return on investment the way Puerto Rico does. 60-2019 hereinafter the Incentives Code.

Amend Section 8 of Act No. Through this combination a medical doctor in Puerto Rico can receive tax free dividends and a 4 rate on income in excess of Act 14s 250000 cap. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

Exempt businesses with 2 tax rate. 165-1996 as amended known as the Rental Housing Program for Low. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1 2019 with an effective date of January 1 2020The Incentives Code consolidates various tax decrees incentives subsidies.

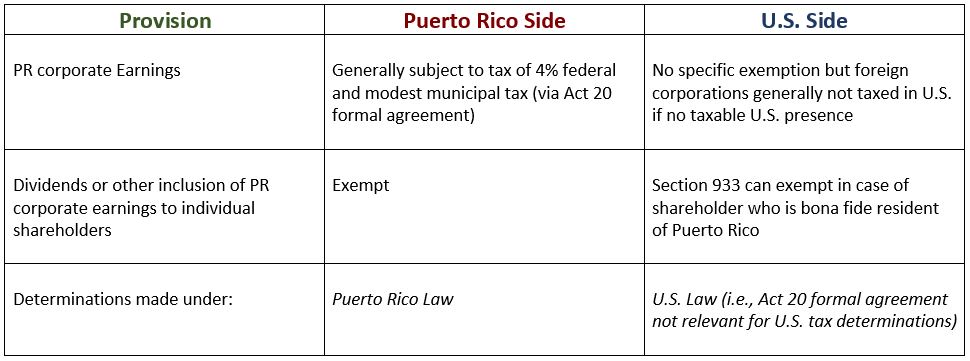

Last reviewed - 21 February 2022. Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021.

In the 1950s and 1960s some manufacturing concerns established plants in Cayey taking advantage of tax incentives offered by Operation Bootstrap Puerto Ricos industrialization program. Fixed income tax rate on eligible income. Make the necessary investment in a commercial enterprise in the United States.

Revenue Code for a New Puerto Rico. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here. 1635 known as the Incentive Code of Puerto Rico and enrolled as Act No.

On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute including Act No. Puerto Rico Tax Incentives. USCIS administers the EB-5 Program.

According to Section 102001a61 of the Code a small and medium sized businesses is an Exempt Business that generates an average volume of business of three million dollars. The updated requirements are mentioned in this article but for ease we have kept the original names Act 20 and Act 22 when discussing these. The Incentives Code consolidates incentives granted for diverse purposes throughout decades like manufacturing activities and.

Corporate - Tax credits and incentives. Act 20 Act 22 Act 27 Act 73 Act 273. Sometimes effective tax planning can help avoid these taxes.

This resulted in some adjustments to the qualification requirements among other changes.

A Second Look At The Incentives Code Kevane Grant Thornton

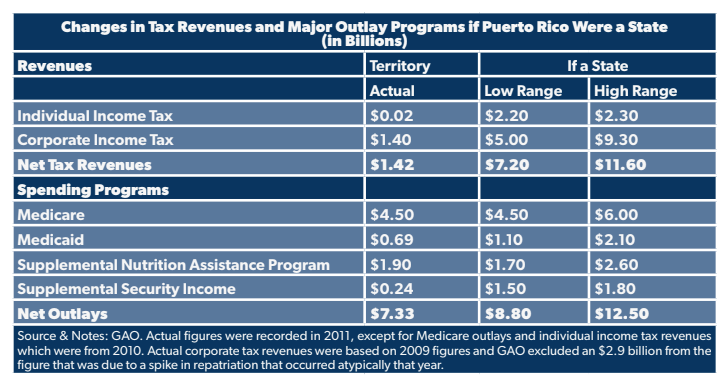

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Best Commercial Industrial Real Estate Listing Company In Puerto Rico

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Puerto Rico Tax Incentives Defending Act 60 Youtube

Puerto Rico Has A New Tax Incentives Code

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Incentives Code Tax Alert Rsm Puerto Rico

Invest Puerto Rico The Puerto Rico Incentives Code Act 60 Compiles Most Of Puertorico S Tax Incentives Under One Law Establishing An Efficient Process For Granting And Leveraging The Benefits Of These

Puerto Rican Tax Incentives Youtube

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Amendments To The Puerto Rico Internal Revenue Code Grant Thornton

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Changes To Act 20 22 New Incentives Code Of Puerto Rico For Jan 1 2020 Relocate To Puerto Rico With Act 60 20 22

Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativocentro De Periodismo Investigativo